By Administrator_India

European stock markets weakened Wednesday, after a five-day rally, as investors reined in their bets on a swift and thorough economic rebound later in the year.

At 3:45 AM ET (0745 GMT), the U.K.’s FTSE index traded 1.2% lower, France’s CAC 40 was down 1.3%, while the DAX fell 1.6%. The broader based Stoxx 600 Europe index climbed 2%.

In the first World Economic Outlook report since the COVID-19 coronavirus pandemic began, the International Monetary Fund estimated that global GDP will shrink 3% this year, the worst economic downturn since the Great Depression of the 1930s.

France has already predicted an 8% contraction in its GDP, while the U.K.’s Office for Budgetary Responsibility said Britain’s economy could shrink by 35% this spring, with the budget deficit blowing out to over 100 billion pounds ($125 billion).

In corporate news, Smurfit Kappa Group ‘s shares fell 1.4% after the packaging company suspended its final dividend for 2019 due to the coronavirus pandemic.

Shares in Jupiter Fund Management slumped 7% after it said that total assets under management decreased sharply in the first quarter of 2020 as a result of market movements and 2.3 billion pounds in net outflows of client funds.

Dutch navigation and digital mapping company TomTom shed 3.4% after saying it expected negative free cash flow this year and lower revenue from its automotive and consumer businesses due to the pandemic. ASML Holding NV a Dutch maker of chipmaking equipment, fell 2.2% after its first-quarter results came in at the lower end of its revised guidance.

Oil prices have fallen Wednesday amid skepticism that OPEC’s plan for deep global cuts in output will be followed through.

On weekly stockpiles data, the Energy Information Administration is expected to report later Wednesday that U.S. crude stockpiles rose by 11.6 million barrels last week, after having risen 30.6 million barrels over the past three weeks.

At 3:45 AM ET, U.S. crude futures traded 0.5% lower at $20.02 a barrel. The international benchmark Brent contract fell 1.9% to $29.01.

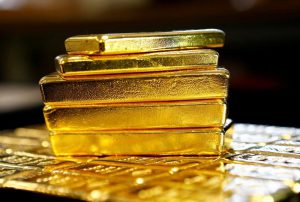

Elsewhere, gold futures fell 1.8% to $1,736.35/oz, while EUR/USD traded at 1.0936, down 0.4% on the day.