By Ritu

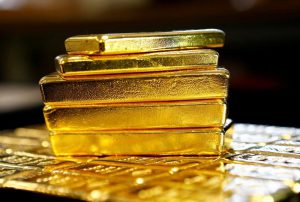

Gold traded marginally lower on Tuesday morning in Asia, hovering around the $1,468 range as the U.S. and China are still in talks for ‘deal or no deal.’

Gold Futures contracts traded at $1,467.95 by 10:00 PM ET (03:00 GMT), down 0.09%.

Talks of a possible “phase one” deal between the world’s two largest economies dominated the market this morning, weighing on the precious metal that is seen as a safe-haven asset.

The trade deal was still possible by the end of the year and the first phase of the agreement was being put to paper, according to Kellyanne Conway, a senior adviser to U.S. President Donald Trump.

“There’s a better than 50-50 chance we will get a ‘phase one, skinny’ deal, largely because both presidents, Trump and Xi, need this for domestic political reasons,” Stephen Roach, a senior lecturer at Yale University’s Jackson Institute for Global Affairs, told CNBC.

Gold prices edged up earlier this morning on the overnight news that U.S. President Donald Trump renewed steel and aluminum tariffs on Brazil and Argentina. The move reignited fear of global trade disputes and hampered risk appetite.

The prospects of a trade deal remain unclear as well. Trump said on Monday that the signing last week of two pieces of legislation in the US that support protesters in Hong Kong would not make negotiations easier, but that China still wants a deal.